AUTHORIZED USER TRADELINE

WE GUARANTEE OUR LINES WILL POST!!

Boost Your Credit Scores In

A Couple Weeks!!

Market Leader

We use innovative technologies to efficiently serve 100’s of clients monthly. We have partnered with 135+ cardholders to give you and your clients access to one of the largest AU inventories in the market. Our goal is to be the #1 company in this space!!

Why Choose Us?

![]() Established Industry Leader

Established Industry Leader

![]() No Risk Guarantee

No Risk Guarantee

![]() Hassle-Free Ordering System

Hassle-Free Ordering System

![]() Large Inventory

Large Inventory

![]() Responsive Staff

Responsive Staff

What We Do

We partner with cardholders with excellent credit and perfect payment histories to provide you with quality AU tradelines and individualized support in posting those tradelines successfully.

What Is An Authorized User?

According to www.Balancepronet.com, it is the act of an individual contacting a creditor and adding an authorized user onto a credit card account.

It allows the authorized user to have the primary account holder’s credit history show up on his/her credit report. This can be a tremendous benefit for anyone who is having trouble building a credit history on their own, since an authorized user does not need to go through a credit check to be added to the primary cardholder’s account. The authorized user strategy is one that has been used for many years to help jump start the credit enhancement process.

We Will Provide You The Same Exceptional Service, We’d Want To Experience Ourselves!!

If your tradeline doesn’t post, we will find a comparable replacement within 3 business days and you will receive a FREE 3-day/2-night get-a-way vacation.

In the event we can’t offer an immediate replacement of equal or greater value, WE WILL REFUND 100% OF YOUR MONEY, AND you will receive a FREE 3-day/2-night get-a-way vacation (for the inconvenience).

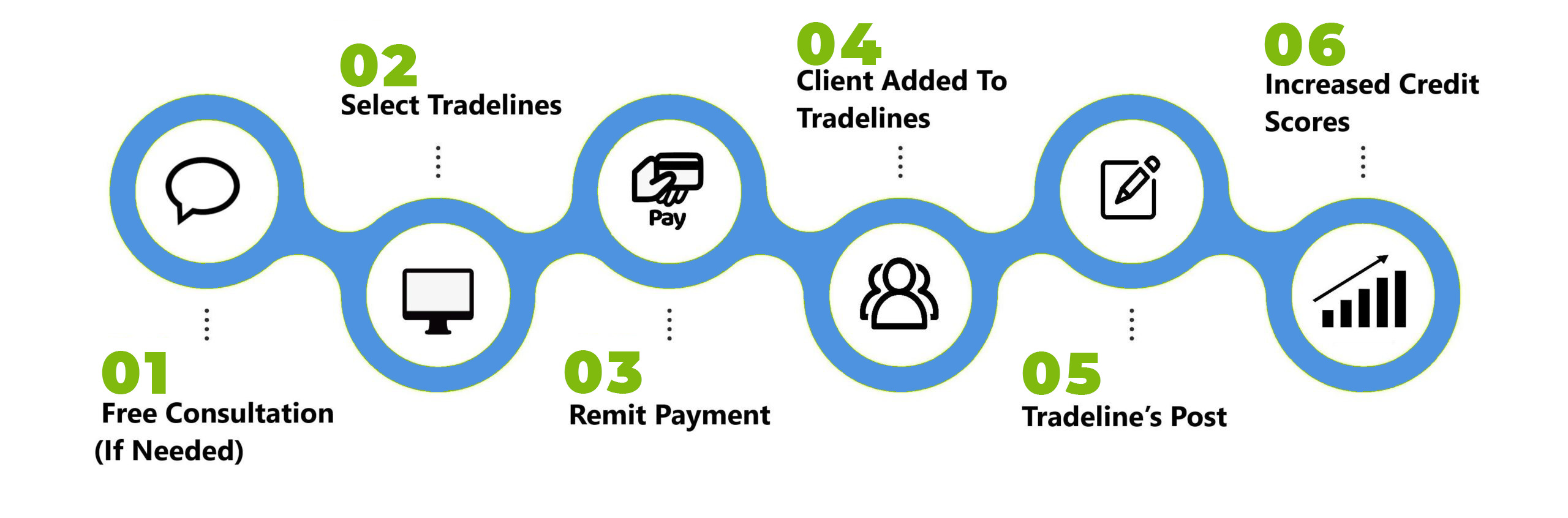

our process

SO, HERE IS HOW WE’VE DONE SO FAR

YEARS IN BUSINESS

TRADELINES AVAILABLE

TRADELINES SOLD

YEARS IN BUSINESS

TRADELINES AVAILABLE

TRADELINES SOLD

CUSTOMERS SERVED

AVERAGE CREDIT SCORE POINT INCREASE

CUSTOMERS SERVED

AVERAGE CREDIT SCORE POINT INCREASE

Take our tradeline assessment

See which tradelines are the best fit for you and your financial needs.

our sample tradlines prices

Here’s a sample of our tradelines to give you an idea of our inventory and pricing.

Barclays

- Credit Limit: $40,000

- Issuance Year: 2013

Citi

- Credit Limit: $6,000

- Issuance Year: 2014

Chase

- Credit Limit: $16,500

- Issuance Year: 2010

Wells Fargo

- Credit Limit: $13,000

- Issuance Year: 2015

Case Study #1

Client had original scores of mid 500’s and scores increased to 800+ in 45 days!! Click below button to view the entire case study.

Case Study #2

Client did not have enough data to generate a score, and after adding a couple of tradelines, his score increased to 750+ in just 40 days!! Click below button to view the entire case study.

Case Study #3

Client’s scores increased from the low 600’s to the low 700’s in less than 30 days!! Click below button to view the entire case study.

ADDITIONAL SERVICES

credit restoration

Business credit &

funding

HEALTH & WELLNESS

Cryptocurrency

REAL ESTATE

personal funding

BUSINESS CREDIT &

fUNDING DO-IT-YOUrSELF

WEB/APP DESIGN

boost your credit scores now

Pricing & Plans

schedule free

consultation

Contact Us

Call us

1.888.391.0371

TRADELINE INVENTORY

PLACE A CHECKMARK NEXT TO THE TRADELINE(S) TO BEGIN THE ORDER PROCESS